|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

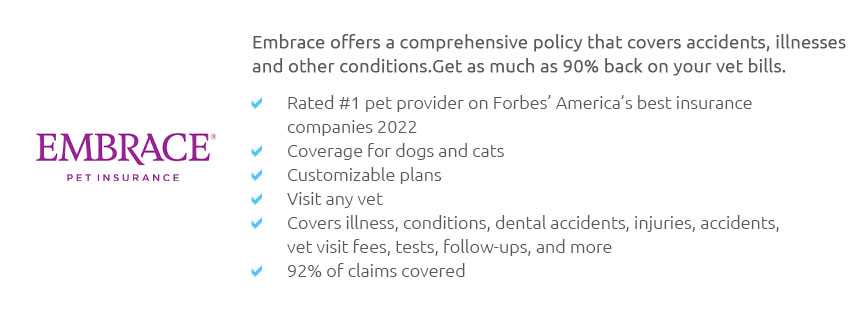

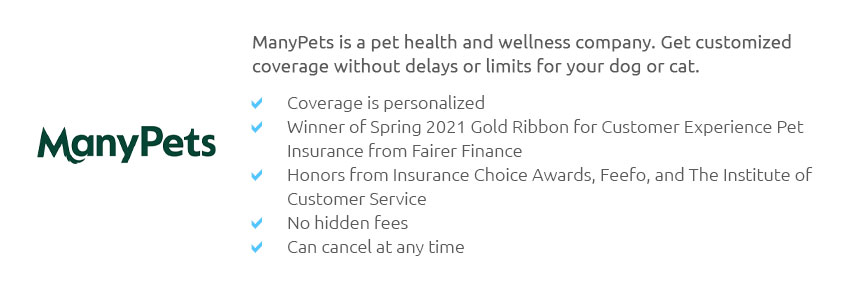

Choosing the Right Pet Insurance Company: A Comprehensive GuideWhen it comes to ensuring the health and well-being of our beloved pets, selecting the right pet insurance company can make all the difference. With myriad options available, each offering a variety of plans, coverage levels, and premiums, the decision can seem daunting. However, understanding the nuances of what constitutes a good pet insurance company can help pet owners make informed choices. First and foremost, a reputable pet insurance provider should offer comprehensive coverage that includes both accident and illness plans. While some companies offer accident-only plans at a lower cost, the best options provide thorough coverage for a wide range of conditions and treatments. This often includes surgeries, medications, hospital stays, and even alternative therapies like acupuncture and physiotherapy. Furthermore, a good policy should encompass chronic and hereditary conditions, which are vital for breeds prone to certain health issues. Customer service is another critical factor to consider. A reliable pet insurance company should have a reputation for excellent customer support, with knowledgeable representatives who can provide clear answers to policyholders’ questions. The claims process should be straightforward and efficient, minimizing stress during what can often be a difficult time for pet owners. Another aspect to consider is the flexibility and transparency of the policy. A good insurance company should offer customizable plans that allow pet owners to select the level of coverage that best fits their budget and needs. Additionally, transparency regarding what is and isn’t covered, as well as any exclusions or limitations, is crucial. Hidden clauses can lead to unexpected expenses, so clear communication from the insurer is essential. Price, of course, plays a significant role in the decision-making process. While it might be tempting to opt for the cheapest option, it’s important to weigh cost against the level of coverage provided. Often, mid-range priced policies offer the best value for money, balancing reasonable premiums with comprehensive coverage. Discounts for insuring multiple pets or for purchasing annual plans upfront can also be beneficial. Lastly, one should consider the company's reputation and reviews from other pet owners. Online reviews and testimonials can provide insight into other customers’ experiences, revealing both the strengths and potential pitfalls of different companies. Trustworthy companies often have consistent positive feedback and are recommended by veterinarians. FAQWhat is typically covered by pet insurance? Most comprehensive pet insurance policies cover accidents, illnesses, surgeries, medications, and sometimes even alternative therapies. Coverage can vary, so it’s important to review what each policy offers. Are pre-existing conditions covered? Generally, pet insurance does not cover pre-existing conditions. However, some companies may offer coverage for conditions considered “curable” if the pet remains symptom-free for a certain period. How do I file a claim? Filing a claim typically involves submitting a form provided by the insurer, along with invoices from your veterinarian. Some companies offer online claim submissions, which can expedite the process. Can I visit any veterinarian with pet insurance? Most pet insurance policies allow you to visit any licensed veterinarian, including specialists and emergency clinics, although it's wise to confirm this with your chosen provider. How do premiums change as my pet ages? Premiums often increase as your pet ages due to the higher likelihood of health issues. Reviewing your policy’s terms regarding age-related premium increases is important when choosing a plan. https://www.aspcapetinsurance.com/research-and-compare/compare-plans/compare-pet-insurance-plans/

comparing pet insurance plans for your cat or dog ; Yes, No, Yes, No ; Yes, No, Yes, No ... https://www.thetimes.com/money-mentor/pet-insurance/best-pet-insurance

Petsure was named the Best Pet Insurer at Times Money Mentor Awards 2024. No excess, no upper age limit and cover for pre-existing conditions. https://www.cnbc.com/select/best-pet-insurance/

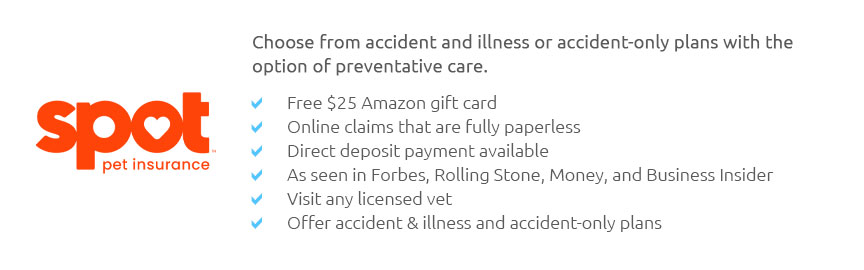

Best pet insurance - Best for preventative care: Spot - Best for cats: Pets Best - Best for dogs: Lemonade - Best for senior pets: Figo - Best for ...

|